There's no getting around it. Every purchase of a property involves additional costs besides the purchase price.

The cost of buying your property in Spain

There's no getting around it. Every purchase of a property involves additional costs besides the purchase price. This does not have to mean that you will be lost in a labyrinth of taxes, additional taxes and sky-high bills. On the contrary, we are happy to guide you through the purchase process in complete transparency so that you know exactly what costs are involved in buying and owning a property in Spain.

The purchase price

The biggest cost of your new home is obviously the purchase price and the one-off costs and taxes associated with the purchase. The good news is that in Spain you can enjoy a very competitive purchase price and also the purchase costs for new properties are much lower than in Belgium.

The downside is that these purchase costs and also the tax rates can differ per autonomous region. On average, the one-off purchase cost in Tenerife is 10% and 12% to 14% for the other regions.

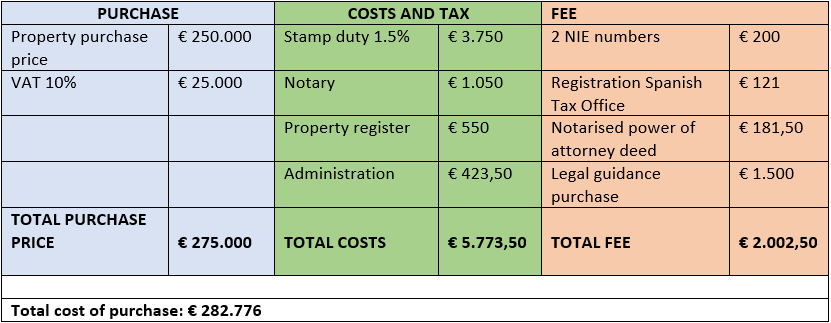

Example: Purchase of new-build home

A couple buys a newly built house in the Comunidad Valenciana (Alicante, Valenciana and Castellón) for €250,000.00.

For this couple, the purchase cost is 13% of the purchase amount.

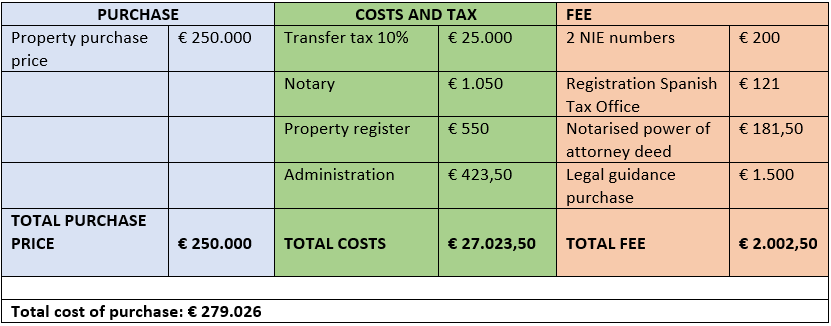

Example: Purchase of existing property

The same couple buys an existing property instead of a new build. What impact does this have on the cost?

For this purchase, the purchase cost is 11.6% of the purchase price.

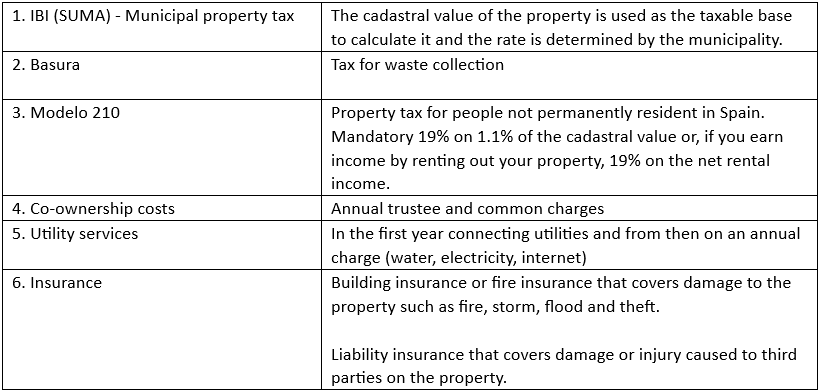

Annual costs and taxes

As in Belgium, besides the one-off costs and taxes, there are also the annual recurring costs and taxes for owning a property in Spain.

These annual costs depend on the cadastral value of your property, the type of property and its location. You should take the following annual costs into account:

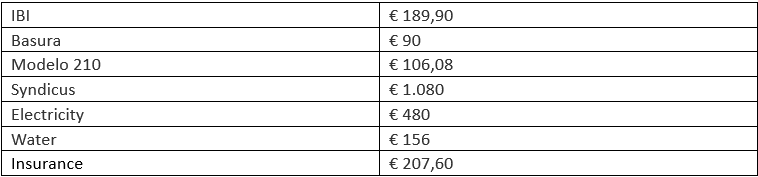

Example: Recurring costs and tax

A couple buy a two-bedroom penthouse flat of 100 m² in Tenerife, Granadilla de Abona. On an annual basis, their recurring costs come to:

What about Belgian tax?

In Belgium, you pay no extra tax on your property in Spain. Of course, the property must be declared to the Belgian tax authorities, who then determine a cadastral value. You will not be taxed extra on this because there is a double taxation treaty with Spain. The Belgian tax authorities give an exemption under 'progression reservation'. That is, this extra income is taken into account when determining the tax rate on other income, but the impact is usually small.

Author: Filip Berger